A top executive at financial services giant Fidelity Investments believes that Bitcoin (BTC) is currently a bargain.

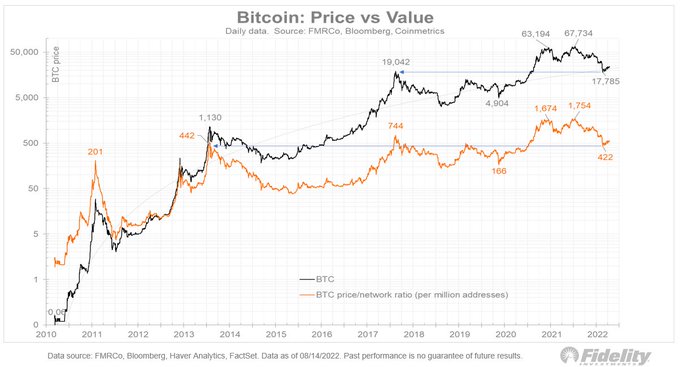

Fidelity’s director of global macro Jurrien Timmer says that based on the thesis that Bitcoin price will rise as its network grows, the flagship crypto asset is looking “cheap”.

“If you believe in Bitcoin’s adoption-curve thesis (i.e. that the network will continue to expand in line with previous S-curves), then it’s reasonable to view Bitcoin as cheap at these levels.”

According to the macro expert, the price of Bitcoin is below the actual and projected growth of its network.

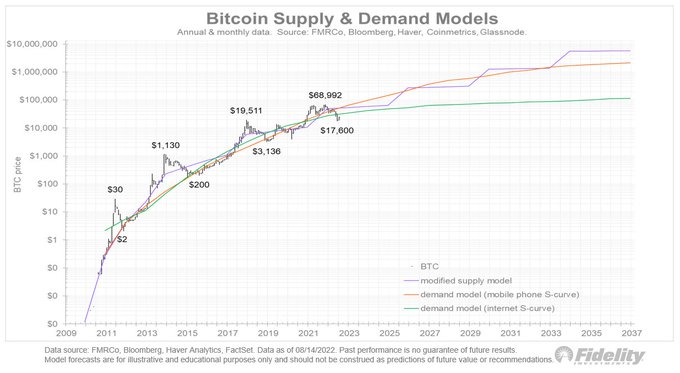

“For me, the main nuance is the slope of the adoption curve. Whether we use the mobile-phone curve or internet curve as proxies, Bitcoin’s price is below its actual and projected network-growth curve. That curve provides a fundamental anchor for Bitcoin’s price.”

Timmer has previously explained that Bitcoin’s adoption rate is likely to mirror that of mobile phones or internet technology.

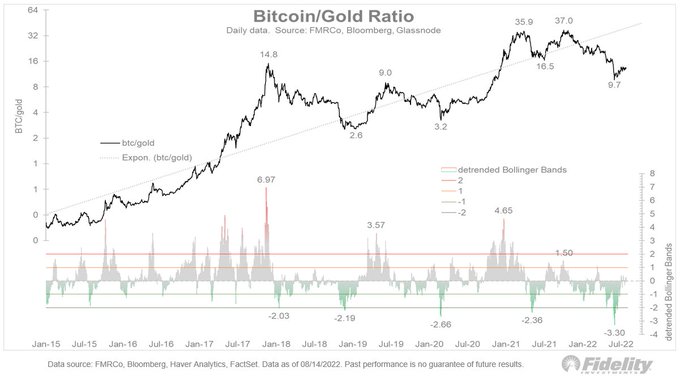

Using the analogy of Bitcoin as digital gold, Timmer says that the king crypto was massively oversold during the recent market downturn and has deviated from the trend when the two are compared side by side.

“If Bitcoin is gold’s precocious younger sibling, it makes sense to look at Bitcoin priced in gold (i.e., Bitcoin’s beta to gold). Technically, the recent sell-off produced the biggest oversold condition in years (measured as the number of standard deviations from trend).”

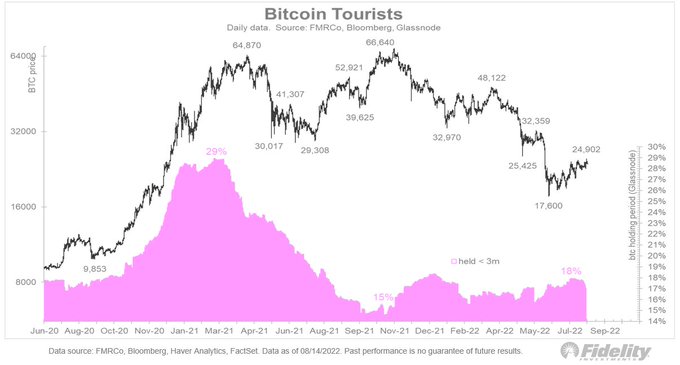

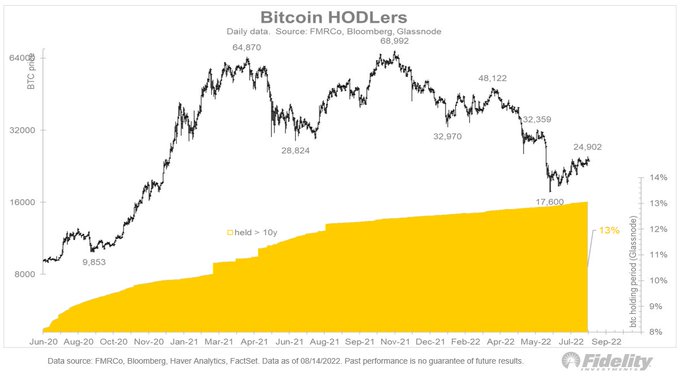

The macro expert also says that amid the crypto downturn, the percentage of Bitcoin held for less than three months (short-term holders) remains relatively unchanged while the percentage of Bitcoin held for over 10 years (long-term holders) is rising.

“Who is buying Bitcoin these days? Apparently not the tourists (i.e., short-term holders). The percentage of Bitcoins held less than three months has barely budged lately.”

“But the number of HODLers keeps growing. The percentage of Bitcoin held for at least 10 years is now 13%.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Maria Starus