Crypto asset manager CoinShares says that institutional short-selling of Bitcoin (BTC) hits its highest in 2022.

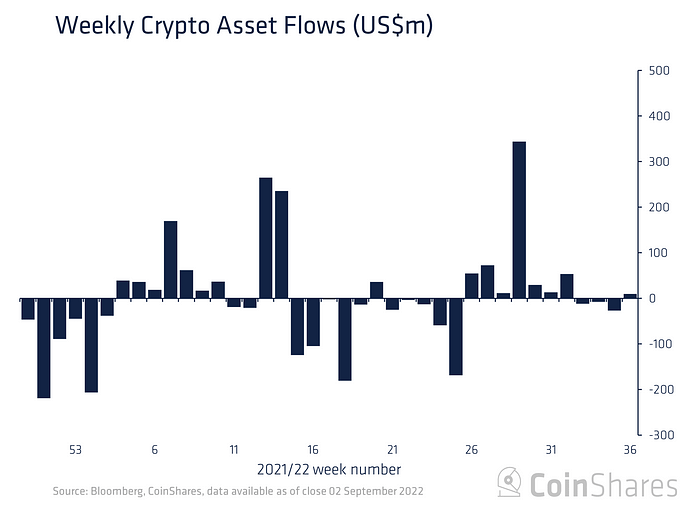

In its latest Digital Asset Fund Flows Weekly report, CoinShares says that inflows to short-Bitcoin investment products peaked this year with a record inflow of $18 million last week.

This brings the total value of short Bitcoin investment products under management to a record high of $158 million.

The flagship crypto asset also saw outflows totaling $11 million, marking the fourth straight week of outflows totaling $70 million.

Crypto investment products in general saw minor inflows totaling $9.2 million, most of which was allocated for short investment products.

From $64 billion at the beginning of 2022, the value of assets under management (AUM) plunged to $27.9 billion, the lowest since early July.

Data also shows that US investors particularly exhibit negative sentiment with far lower inflows than their counterparts in other regions.

“Regionally, the data shows diverging sentiment despite the low trade sizes. Canada, Brazil, Switzerland and Germany all saw inflows totaling $4.7 million, $3.2 million, $1.7 million and $1.6 million respectively.

The sole focus of negative sentiment was from the US, where inflows totaled $0.8 million, being masked by predominant inflows into short-Bitcoin investment products.”

The bearish sentiment comes following the Federal Open Market Committee (FOMC) meeting at Jackson Hole, where top financial authorities express hawkish views amid the current downturn and rising inflation rates.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Art tools design/PurpleRender