A popular crypto analyst thinks Bitcoin (BTC) and the broader altcoin markets could start to bounce back next year.

In a new analysis, pseudonymous trader TechDev says that the crypto correction actually began in the second quarter of 2021, rather than the fourth quarter of that year after Bitcoin hit its all-time high.

“We start with the altcoin market cap, where I view the market divided into a cyclical set of regions, Correction > Accumulation > Markup. The below chart should indicate why I believe we’re in accumulation, and that markup is expected next.

It also serves as further evidence of the correction starting Q2 2021, breaking the local RSI uptrend just as the correction before.”

RSI stands for relative strength index, a metric analyzing the crypto asset’s candle oscillation over 14 periods.

TechDev thinks the broader market structure mimics late 2016/early 2017.

“It’s just taking 1.5-2x longer to develop, as has the rest of the structure thus far.”

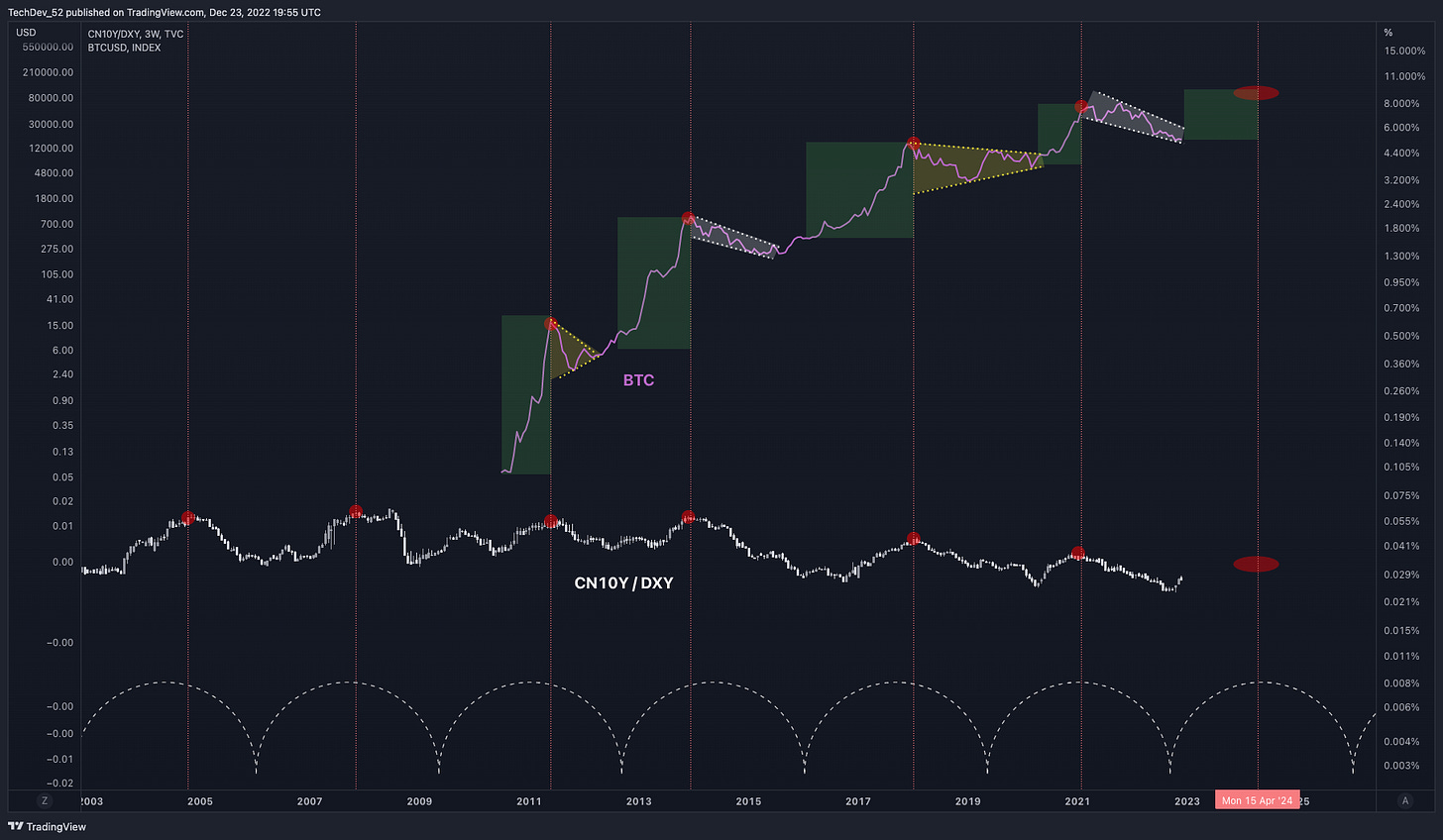

The analyst says Bitcoin has tended to follow the global liquidity “cycle.” TechDev thinks this cycle is portrayed by charting the Chinese 10-year bond yield (CN10Y) over the US dollar index (DXY).

“Note the clear cycle in this chart which has a peak-to-peak timing of roughly 3.4 years that has been printing long before Bitcoin existed.

Each local top in CN10Y/DXY marked or led a major impulse top in Bitcoin, and each local upside reversal marked or led the start of a major Bitcoin impulse.”

The analyst says the chart’s local tops have been “steadily declining along a trendline” since 2014.

“Its next hit could anticipate the next Bitcoin/crypto top. Cyclical timing over the last 20 years suggests this could be around the late 2023-mid 2024 timeframe.”

Read TechDev’s full newsletter here.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/TadashiArt/Natalia Siiatovskaia