A leading digital assets manager is finding that institutional investors are hedging their bets against the U.S. Securities and Exchanges Commission (SEC) in the regulator’s lawsuit against Ripple Labs.

In its latest Digital Asset Fund Flows Weekly report, CoinShares says that institutional investments are inflowing into XRP despite outflows for digital assets as a whole.

“XRP bucked the trend with inflows totaling $3 million representing 9% of total [assets under management].”

The SEC alleges that XRP was an unregistered security upon its launch and that it remains a security to this day. However, CoinShares suggests investors seem to think the SEC’s arguments will ultimately fail in court.

“We believe the improving clarity on its legal case with the SEC is being seen as increasingly favorable for XRP by the investment community.”

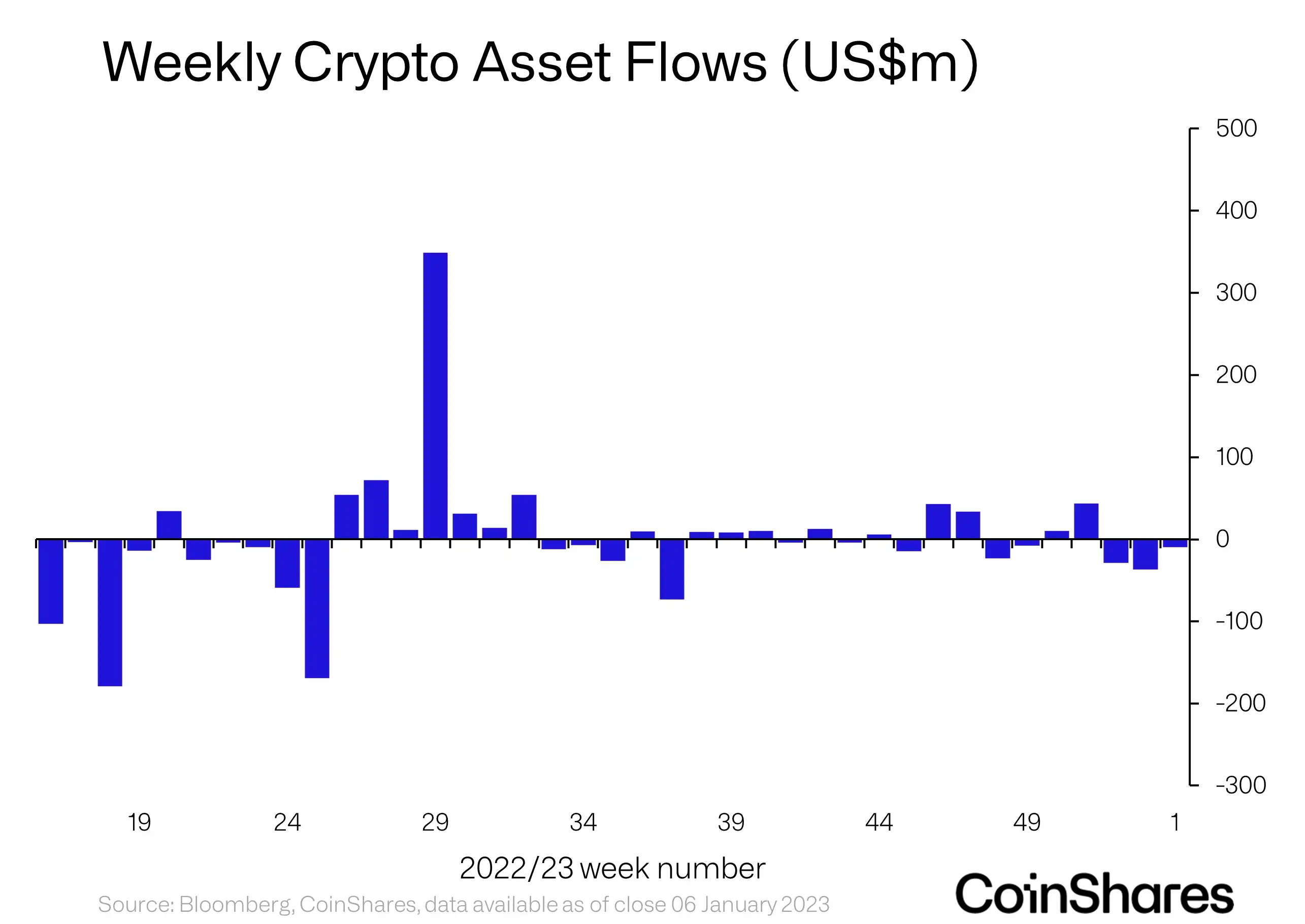

Overall, digital asset institutional investment products suffered outflows last week, continuing a trend that began in late 2022.

“Digital asset investment products saw outflows totaling $9.7 million, highlighting continued mild negative sentiment that has persisted for the last three weeks.”

The leading digital asset by market cap, Bitcoin (BTC), suffered its lion’s share of the outflows.

“Bitcoin saw minor outflows, totaling $6.5 million, for the third week in a row, implying sentiment at the beginning of 2023 remains negative.”

Ethereum (ETH) investment products suffered losses for the eighth week in a row, experiencing outflows of $3.1 million. Multi-asset digital investment products, those investing in more than one crypto, had $4.5 million in outflows last week. Institutional investment vehicles focusing on altcoins Binance Coin (BNB) and Litecoin (LTC) enjoyed $0.2 million in inflows, respectively.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/moxumbic/INelson