Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin (BTC) will likely face a big test in the second half (2H) of 2023.

McGlone tells his 58,800 Twitter followers that after a strong performance in the first half of the year (1H) Bitcoin will likely have to endure tough recessionary conditions during the next six months.

The macro expert predicts that the stock market will start to decline and Bitcoin will have a chance to prove itself as a store of value, or “digital gold,” by not dipping along with equities.

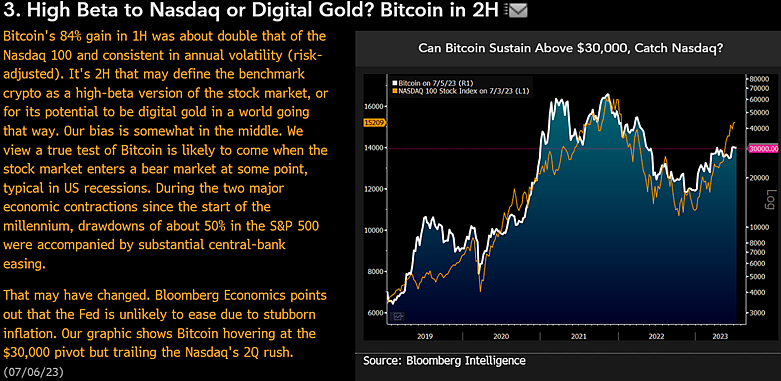

“Bitcoin’s 84% gain in 1H was about double that of the Nasdaq 100 and consistent in annual volatility (risk-adjusted). It’s 2H that may define the benchmark crypto as a high-beta version of the stock market, or for its potential to be digital gold in a world going that way.

Our bias is somewhat in the middle. We view a true test of Bitcoin is likely to come when the stock market enters a bear market at some point, typical in US recessions.”

McGlone also warns that while in past recessions the Federal Reserve was quick to ease monetary policy, the central bank may be reluctant to do so this time around due to high inflation.

“During the two major economic contractions since the start of the millennium, drawdowns of about 50% in the S&P 500 were accompanied by substantial central-bank easing. That may have changed. Bloomberg Economics points out that the Fed is unlikely to ease due to stubborn inflation. Our graphic shows Bitcoin hovering at the $30,000 pivot, but trailing the Nasdaq’s 2Q rush.”

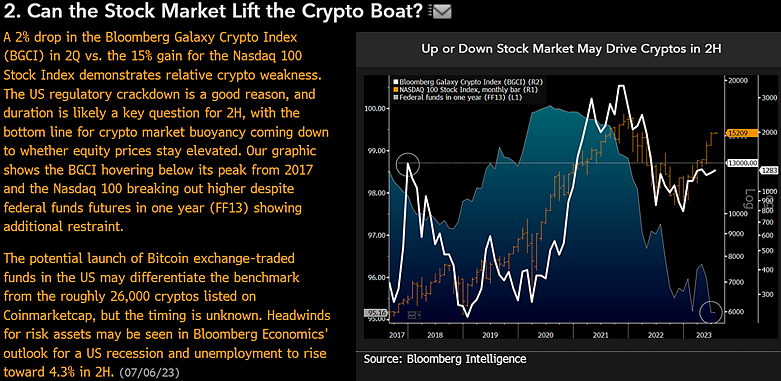

According to McGlone, a weakening crypto market was already exposed during the second quarter (2Q) of the year as equities gained while top digital assets, which are tracked by the Bloomberg Galaxy Crypto Index (BGCI), declined.

“Midyear Outlook: Cryptos – The stock market continuing to post gains may chip away at the foundation for cryptos. That the Bloomberg Galaxy Crypto Index dropped in 2Q despite the sharp bounce in the Nasdaq 100 Stock Index suggests divergent weakness for the crypto market. A 2% drop in the Bloomberg Galaxy Crypto Index (BGCI) in 2Q vs. the 15% gain for the Nasdaq 100 Stock Index demonstrates relative crypto weakness…

Our graphic shows the BGCI hovering below its peak from 2017 and the Nasdaq 100 breaking out higher despite federal funds future in one year (FF13) showing additional restraint.”

McGlone also says that headwinds are coming for risk assets like Bitcoin as Bloomberg Economics predicts a recession in the second half of the year with US unemployment hitting 4.3%, up from the current rate of 3.6%.

Bitcoin is trading for $30,415 at time of writing, up 1.2% during the last seven days.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Kartavaya Olya/Konstantin Faraktinov