Bitcoin (BTC) is now checking the three main requirements for another explosive rally to new all-time highs, according to a popular crypto analyst.

Pseudonymous analyst TechDev tells his 418,000 followers on social media platform X that Bitcoin has now hit the “3-prong signal” that previously foreshadowed the other four BTC rallies to new highs.

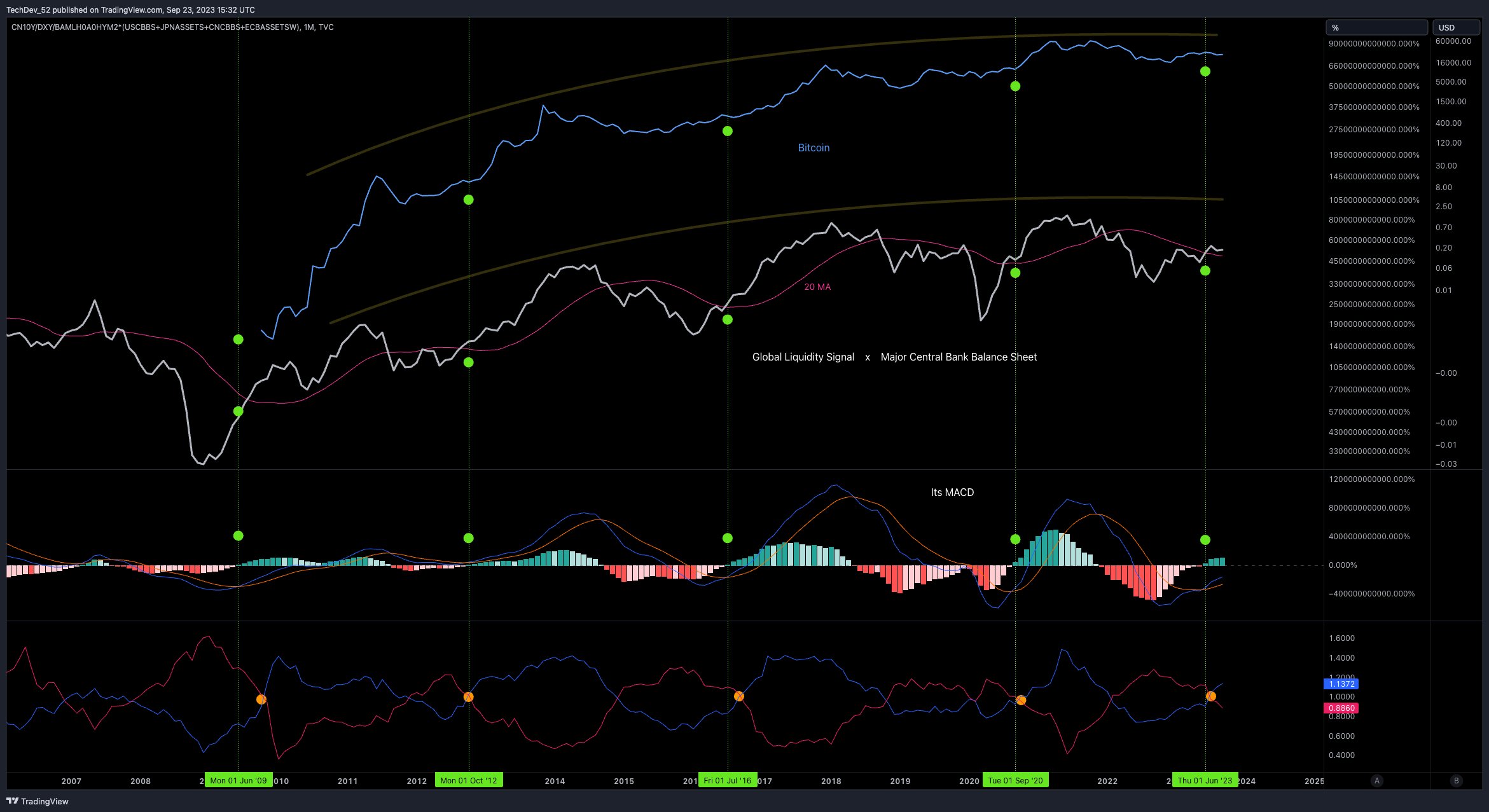

TechDev places a Bitcoin price chart against three other indicators. The first is his own “global liquidity signal” versus the balance sheets of major central banks. The analyst’s liquidity signal attempts to depict global cycles of dollar liquidity by pitting the dollar index (DXY) against Chinese 10-year bonds (CN10Y).

The other two indicators are the moving average convergence divergence (MACD) and the monthly vortex, two trend reversal indicators that have both crossed bullish by according to traditional interpretation.

“The 3-prong signal which preceded each of Bitcoin’s four ATH-setting runs:

- Break above 20M MA

- Monthly MACD bull cross

- Monthly Vortex bull cross

…of a global liquidity proxy which oscillates with a ~3.5 year cycle.

And also has a log growth trajectory.”

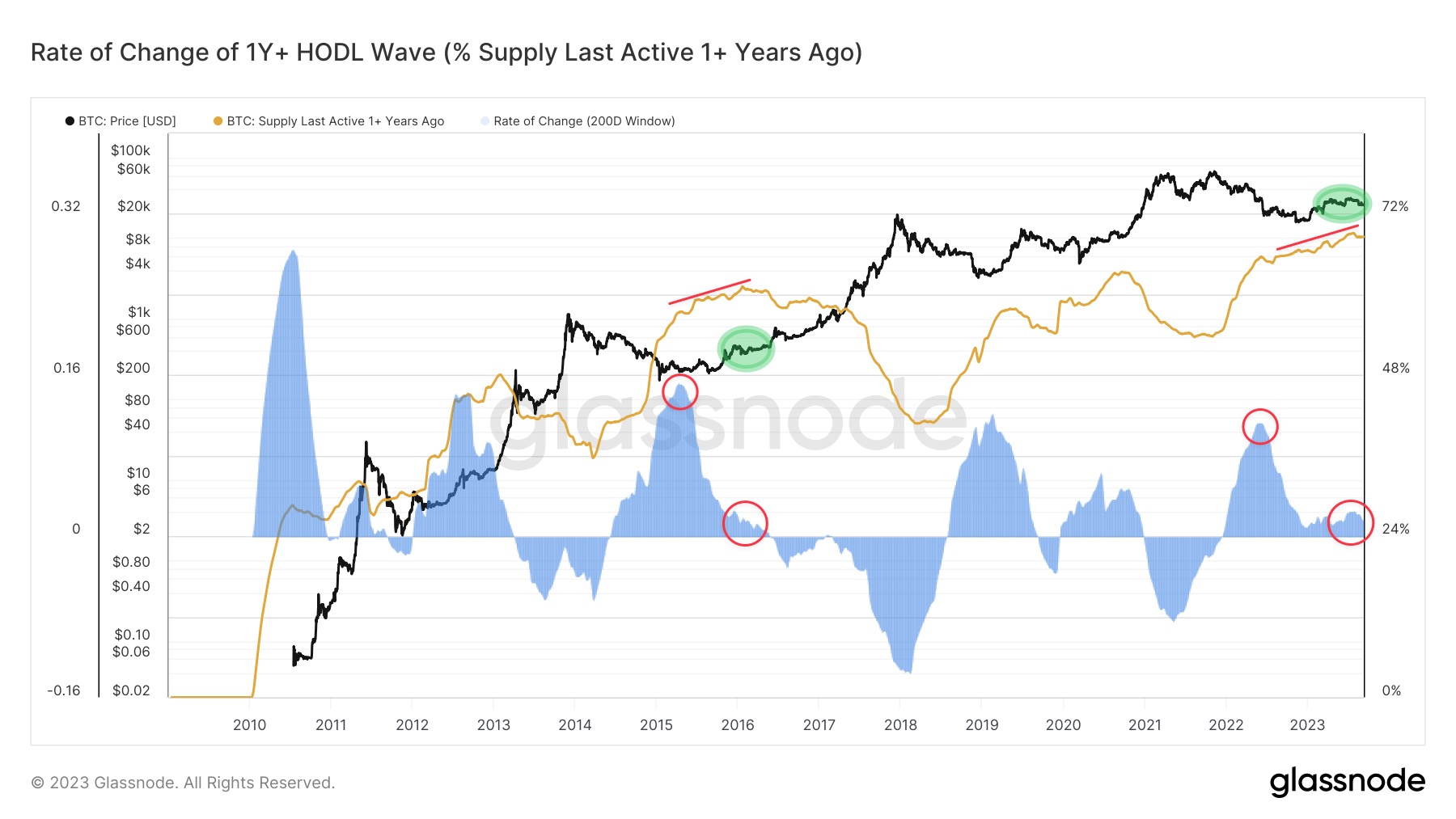

In a separate post, TechDev shares data from analytics firm Glassnode that appears to suggest that certain on-chain activity is behaving the same as a previous bull run. The Glassnode chart depicts a rise and then plateauing of the amount of BTC laying dormant for more than a year, while the 200-day rate of change of the same metric slowly declines below zero.

As indicated by TechDev’s green circles, the same situation happened in the 2015-2016 market cycle.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney