A top analyst for the crypto analytics firm Glassnode believes Bitcoin (BTC) is gearing up for its next surge.

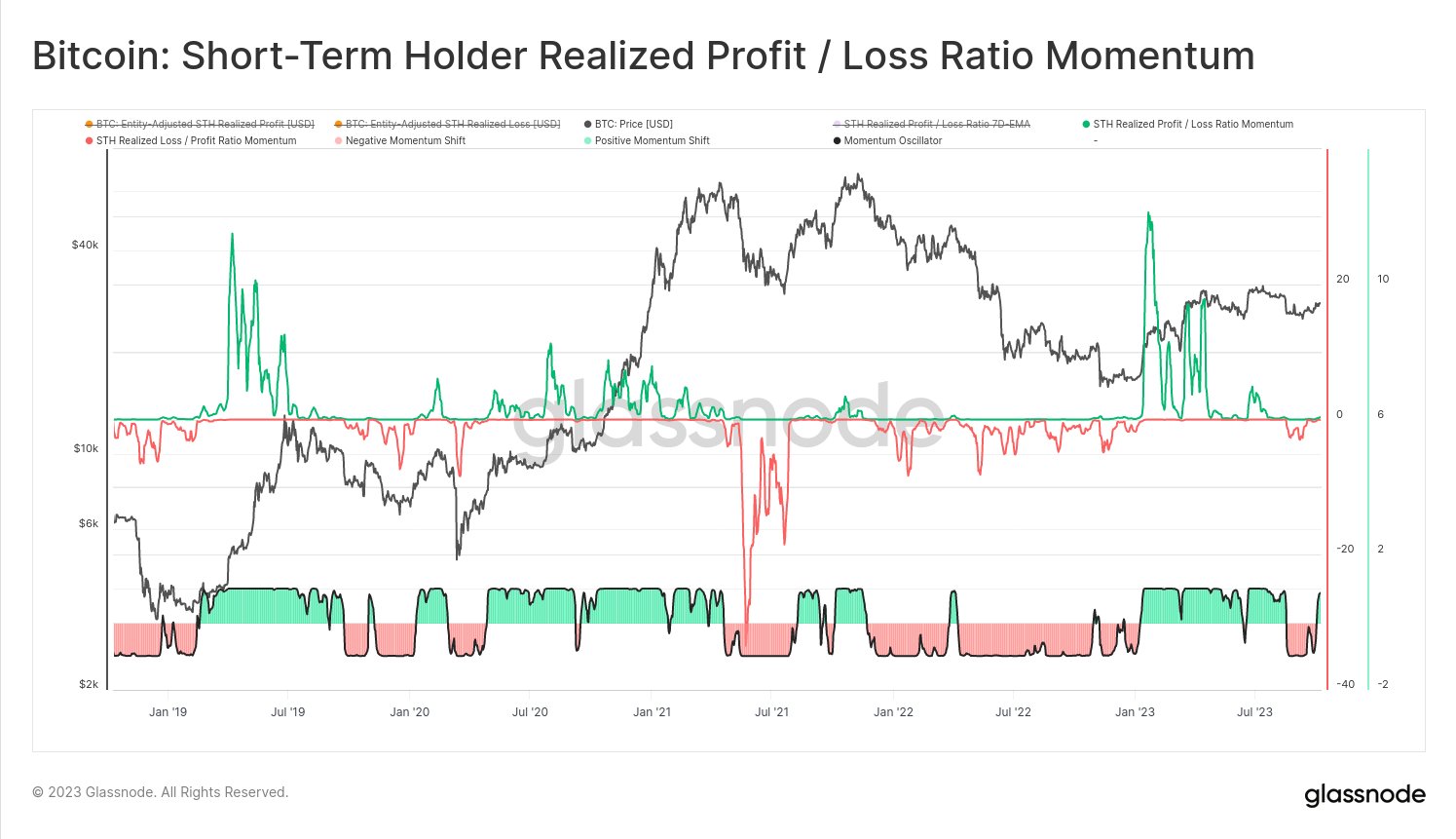

Pseudonymous trader Checkmate, Glassnode’s lead on-chain analyst, says on the media platform X that Bitcoin’s profit/loss momentum for short-term holders metric has recently recovered and is in the green again.

The profit/loss momentum indicator aims to identify an asset’s existing trend, according to Glassnode. The analytics firm defines short-term holders as traders who have held Bitcoin for less than 155 days.

Checkmate says the metric is “the most responsive on-chain trend indicator” Glassnode has ever developed.

Says the on-chain analyst,

“The bears took it negative on the sell-off from $29,000 to $26,000. However, they failed to take it lower, despite significant losses being taken by the market (the most bearish the market has been since FTX).

There are two interpretations for the green reversal:

– Final profit-taking before doom.

– Return of strength.”

The analyst says he leans toward the second interpretation due to how well Bitcoin is holding up against the “tumultuous” macro environment.

Checkmate also thinks Bitcoin is still in a “value zone” because the crypto asset is trading below its true market mean price of $29,700. True market mean price “is a representative cost basis model for all coins acquired on secondary markets,” according to Glassnode.

According to Checkmate, there’s no telling what Bitcoin might do in the short term, but he says that value investors believe that BTC bears are wrong at this point.

BTC is trading for $27,629 at time of writing. The top-ranked crypto asset by market cap is down more than 1% in the past 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney