Bankrupt crypto exchange FTX is asking a judge for permission to sell off $744 million worth of assets.

A new bankruptcy court filing shows that FTX and its debtors want permission to sell the company’s Grayscale and Bitwise assets through an investment adviser.

According to the filing,

“Similar to the debtors’ prior request to monetize digital assets, the debtors are requesting court authorization to monetize the trust assets to protect the debtors against potential downward price swings in the trust assets, maximize the value of the debtors’ estates, and allow for forthcoming dollarized distributions to creditors.

The debtors’ judgment is that proactively mitigating the risk of price swings will best protect the value of the trust assets, thereby maximizing the return to creditors and promoting an equitable distribution of funds in the debtors’ plan of reorganization.”

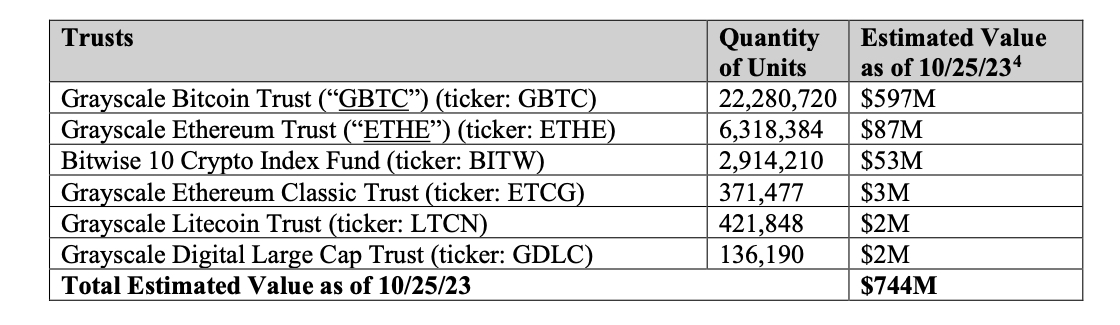

The trust assets include holdings of five different Grayscale Trusts valued at $691 million as of October 25th, as well as holdings of a Bitwise-managed trust valued at $53 million, according to the filing. The trusts are a way to invest in crypto assets without actually owning them.

FTX filed for bankruptcy in November 2022 amid accusations that the exchange’s CEO, Sam Bankman-Fried, mismanaged the firm’s funds.

Last week, Sam Bankman-Fried was found guilty of spearheading a billion-dollar fraud against customers and investors at FTX and trading firm Alameda Research. His sentencing is expected early next year. Bankman-Fried faces a total possible sentence of 115 years in prison.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney