[the_ad id=”36860″]

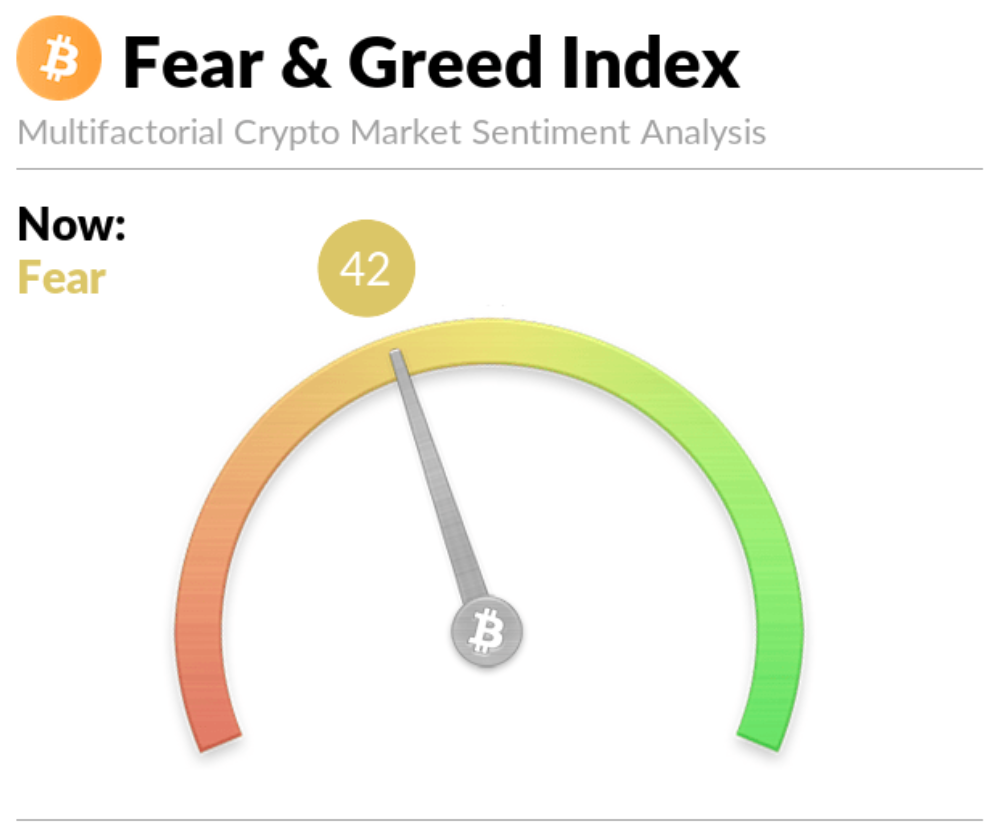

In the aftermath of the Bitfinex and Tether drama, the Crypto Fear and Greed Index is now in the fear zone.

The Alternative.me index, created by developers and creators of Strawpoll.com and Thundercheck.org, analyzes market volatility, surveys and social media to determine the current overall sentiment of crypto traders. The current mark of 42 means investors are worried a further drop in the price of Bitcoin is on the horizon.

The index applies Warren Buffet’s famous advice suggesting traders should be “fearful when others are greedy and greedy when others are fearful.”

According to the site,

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity

- When Investors are getting too greedy, that means the market is due for a correction

[the_ad id=”36860″]

Crypto traders at large are reacting to the news on the Bitfinex and Tether allegations, with Bitcoinist contributor and analyst Filb Filb telling his 13,000 Twitter followers he’s moved to fiat.

Ive Gone to fiat.

Reasonable to assume people will exit Finex, swap USDT -> USD = Downside risk.

Happy to catch a bid below or a sustained break to the upside in USD.

Hopefully all FUD but name of the game is protect gains rn – ill let the superstar traders work this out ? pic.twitter.com/gt18MGqdLd

— filbfilb (@filbfilb) April 26, 2019

Crypto trader and investor Josh Rager tells his 31,000 Twitter followers he thinks the Bitfinex situation will leave the market intact.

https://twitter.com/Josh_Rager/status/1121796383017619456

Crypto analyst Willy Woo, who bought his first Bitcoin in 2013, tells his 91,000 Twitter followers to remember how the markets pulled through in the aftermath of Mt. Gox.

It's good for the ecosystem for crap to be shaken out. Short term there's FUD. I don't think this next bull run will be impacted significantly.

Remember Mt Gox? 5% of all coins stolen, +90% of volume was traded there, it was at heights of mania price, took only 13mths to detox

— Willy Woo (@woonomic) April 27, 2019

[the_ad id=”36860″]

Meanwhile, YouTube’s most popular crypto analyst DataDash says he’s encouraged to see if Bitcoin can hold above $5,000.

“If we’re actually able to hold here a third time, this would actually be quite confident. This has been some of the most bearish news, as we’ll dive into it in a moment, that we have seen in all of 2019. If this isn’t enough to push Bitcoin past this range, or to push Bitcoin below $5,000 and market cap [of all cryptocurrencies] below the $168 billion range, that’s going to be a triple bottom – a sign of confidence for markets to move higher.”

Right now, the crypto market is mixed, with Bitcoin down 1.74% at $5,174, according to Coin360. Ethereum is up 1.25% at $155.61, and XRP is up 0.52% at $0.2950.

Technical analysts are breaking down the short and long term trends in light of the recent pullback.

Bitcoin

NewsBTC – Bitcoin price showing signs of weakness

CoinDesk – 2015 Bitcoin price resistance re-emerges

Ethereum

CryptoGlobe – Bears have to break the 50-day SMA to keep dropping the price

Captain Altcoin – Current level is at a critical defense line

XRP

FXStreet – XRP/USD bears take price below $0.30

NewsBTC – At spot rates, XRP is under pressure

[the_ad id=”36860″]

Litecoin

Crypto Daily – LTC/USD will need to contend with the $72.16 area during a move higher

CoinClarity – Indicator shows normal retracement for Litecoin complete

Stellar, EOS, Bitcoin Cash, Tron, Cardano

NewsBTC – Potential comeback for Bitcoin Cash, XLM, EOS, TRX

Cointelegraph – Institutions wanted: BTC, ETH, XRP, BCH, LTC, EOS, BNB, XLM, ADA, TRX

[the_ad id="42537"] [the_ad id="42536"]