Bakkt and Crypto Custody

Bakkt, the upcoming Bitcoin trading platform from Intercontinental Exchange, has acquired Digital Asset Custody Company (DACC). The company stores customers’ digital assets, protecting Bitcoin and cryptocurrency private keys. By providing a secure custody solution, Bakkt expects to minimize the threat of digital assets being lost due to hacks, a primary concern among institutional and retail investors.

According to Adam White, Bakkt’s chief operating officer,

“It is with that same commitment to setting a new standard for securely storing digital assets that we’re excited to announce that we have acquired Digital Asset Custody Company (DACC). DACC shares our security-first mindset and brings extensive experience offering secure, scalable custody solutions to institutional clients.”

Bakkt says it uses a mix of both cold (offline) and hot wallets that are connected to the internet to secure customer funds.

“The majority of assets are stored offline in air-gapped cold wallets that are insured with a $100,000,000 policy underwritten by leading global insurance carriers. Both wallet architectures employ on-chain and off-chain security measures to safeguard cryptographic keys, including the enforcement of multi-signature controls.

Customer funds are also protected by layers of automated controls including multi-factor authentication, destination address whitelisting, and role-based permissions.”

Bakkt is also building strategic alliances with trusted traditional players in order to open the floodgates for institutional investors. The startup is aligning itself with BNY Mellon to offer a custody solution for private keys that implements geographically-distributed storage.

Writes White,

“BNY Mellon has a longstanding history of safeguarding the assets of institutional clients such as hedge funds, asset managers, and broker dealers, and we’re excited to work with them.”

Bakkt, which was originally set to launch at the end of last year, has hit a snag in its rollout, running into several delays as it awaits regulatory approval of its physically-settled Bitcoin futures product.

The company acquired DACC for an undisclosed sum.

The Bank of England

Mark Carney, governor of the Bank of England, promises to reinvent the 324-old central bank for the “fourth industrial revolution” and customers who have come to expect fast transactions in real time. Speaking at the Innovate Finance Global Summit in London on Monday, Carney says that commerce is in the midst of a metamorphosis.

Yahoo Finance reports that Carney is preparing for a new digital economy.

“The second great wave of globalization is cresting. The Fourth Industrial Revolution is just beginning. And a new economy is emerging.”

“That new economy requires a new finance. A new finance to serve the digital economy, a new finance to support the major transitions underway across the globe, and a new finance to increase the financial sector’s resilience.”

“Consumers and businesses increasingly expect transactions to be settled in real time, checkout to become an historical anomaly, and payments across borders to be indistinguishable from those across the street.”

Governor, Mark Carney: "New finance can unlock more sustainable and inclusive growth, provide consumers greater choice, SME businesses access to credit to grow – all of which ensures the financial system can become more resilient" #IFGS2019 pic.twitter.com/HDrjluZoeD

— Innovate Finance (@InnFin) April 29, 2019

The Bank of England is conducting research into digital currencies and the technology that supports them.

“Cryptoassets combine new payments systems with new currencies that are not issued by a central bank. Examples of privately issued digital currencies include Bitcoin, LiteCoin, Ether (Ethereum) and XRP.

Our Financial Policy Committee has assessed cryptoassets and concluded that they do not currently pose a risk to monetary or financial stability in the UK. However, cryptoassets do pose risks to investors and anyone buying cryptoassets should be prepared to lose all their money.

We continue to monitor developments in this area.”

Venezuela

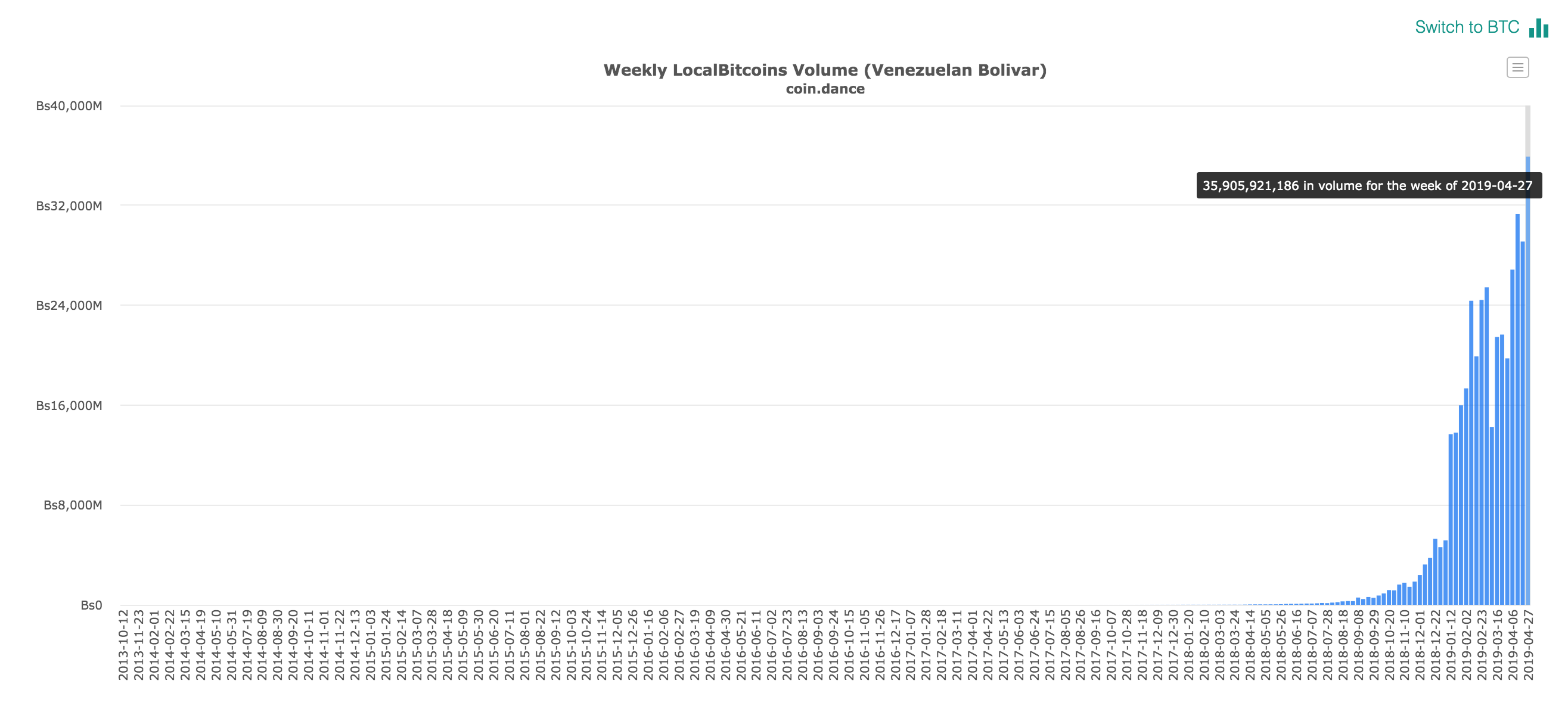

Consumers in Venezuela continue to push Bitcoin to high trading volumes as the country struggles with hyperinflation, political strife and limited food supplies. For the week ending April 27, 2019, users on the peer-to-peer crypto trading platform LocalBitcoins exchanged a record-breaking 35.9 billion Venezuelan bolivar for BTC, up from 29 billion during the previous week, according to data compiled by Coin.dance.

Weekly LocalBitcoins Volume (Venezuelan Bolivar)