The Bitcoin block reward has officially fallen from 12.5 BTC to 6.25 BTC in a highly-anticipated event known as the halving.

Speculation on how the change will reshape the crypto ecosystem has swirled for months. The adjustment, which is designed to happen about every four years, represents a paradigm shift for Bitcoin miners.

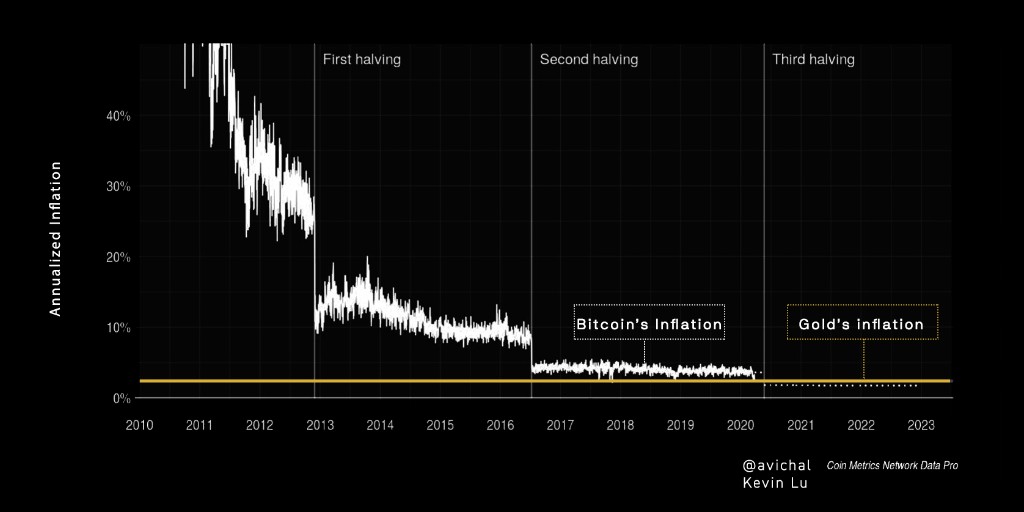

A chart from Electric Capital, using data from Coin Metrics, highlights the fact that Bitcoin now has a lower inflation rate than gold.

This halving is the third and most anticipated in Bitcoin’s 11-year history.

Searches for “Bitcoin Halving” have soared on Google in recent weeks, rising 37% above its previous all-time high set in July of 2016, when BTC was trading around $650.

A countless stream of predictions on the impact the halving will have on the price of Bitcoin have poured in, with analysts predicting it could be a catalyst for Bitcoin’s rise to $100,000, $288,000, $1,000,000 – or have absolutely no impact whatsoever.

Bitcoin’s first halving, which took place in November of 2012, happened when BTC was worth about $11. It then surged to $1,150 in November of 2013 before correcting to a low of $206 in July of 2015.

The next halving, in July of 2016, occurred when BTC was around $650. The next year, BTC famously hit its all-time high of about $20,000 before beginning a long-term bear market with a low of about $3,150.

Bitcoin is currently trading at $8,604, up 1% in the past 24 hours.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/MicroOne