Despite conventional wisdom, analysts at banking giant JPMorgan Chase say that the new Bitcoin Futures ETF is not the reason behind BTC’s surge to a new all-time high.

Company strategists tell Bloomberg that concerns over inflation are driving up the top crypto’s price, rather than excitement over the launch of the first-ever BTC Futures ETF.

“By itself, the launch of BITO is unlikely to trigger a new phase of significantly more fresh capital entering Bitcoin.

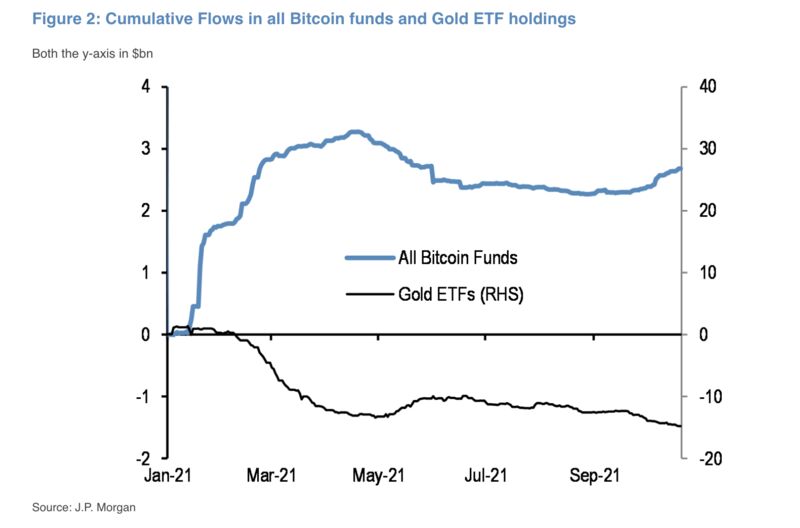

Instead, we believe the perception of Bitcoin as a better inflation hedge than gold is the main reason for the current upswing, triggering a shift away from gold ETFs into Bitcoin funds since September.”

The analysts say BITO, which became the quickest ETF to reach a $1 billion valuation in just two days, could soon lose momentum as competing ETFs hit the market and leave investors with a “multitude of investment choices.”

“The initial hype with BITO could fade after a week.”

JPMorgan’s analysis comes on the heels of billionaire real estate tycoon Barry Sternlicht saying that he invested in Bitcoin and other cryptos due to concerns about Western nations causing inflation by printing too much money.

Bitcoin set a record high of $66,988 on October 20th before dropping to $63,779 at time of writing, according to CoinGecko.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Pixabay/natureworks